A surplus of real estate threatens a stalled economy and raises investment concern

Bloomberg Markets magazine’s upcoming edition will express concern regarding Canada’s debt-fuelled expansion. Toronto, like many major Canadian cities, is damaging the property market due to overwhelming amounts of real estate. If cities continue to disregard their financial limitations and move forward with urban development, a stalled economy may be in our country’s future.

Currently, Toronto is balancing on the edge of crisis as there are more skyscrapers under construction than in any other global city. Furthermore, condo proposals have increased by 10% since last year, totalling 253,789 units with requests pending. This may come as a surprise since Toronto lost 36% in condo sales last year.

For many investors, this may create a situation of “buyer’s remorse,” in which the returned investment for a property is significantly less than expected. As more and more investors try to sublet to cover lost costs, the market values fluctuate enormously. Re-sales have also dropped by 10% in the last few years, meaning investors will also encounter difficulties acquiring new tenants.

Affordability in Canada

In order to fully understand the economic situation in Canada, it is important to take a look back on 2012 and how the event of that year will impact today. In the final quarter of 2012, housing affordability improved overall – in several markets home prices fell and a decline in mortgage rates was happily experienced by homeowners across the country.

In RBC’s most recent report, it is apparent that property values decreased by 0.2-0.3% in 2012. In saying this, it is important to consider that these figures represent national averages and include both extremely poor and wealthy areas. By eliminating these outliers, statistics would should that there is mild affordability strain on the Canadian market.

In many cities market values have increased and it is because of exceptionally low interest rates that ownership is still manageable. If mortgage rates, bank loans, and interest rates were to suddenly change, the affordability of the Canadian market would be much less accessible to the average working-class person.

Despite comfortable affordability, home re-sales are still down 2.6% in 2012’s fourth, which is 8.8% total since 2nd quarter. RBC projects that home re-sales will total 439,000-units in Canada this year, a statistic 3.1% lower than reported in 2012. This may or may not be accompanied by a property value easement.

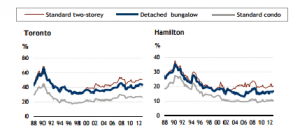

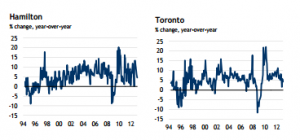

Toronto and Hamilton – Measuring Property Value

Investors are having a hard time in great metropolitan areas due to an over-availability of real-estate. On almost all accounts, 2012 brought only negative statistics for the property market in Toronto. The year had started strong but lost its momentum mid-way, leaving many home-owners at loss.

RBC projections are slightly more hopeful for 2013, predicting that the economy might balance-out and avoid crisis. The following charts illustrate the pressures of 2012 and the effects they had on the economy. The “Sale-to-New” ratio is one to pay close attention to as it may offer insight into where construction is heading in Toronto.

Mortgage Carrying Costs

The following RBC measurements are based on a 25% down-payment, a 25-year mortgage, but does not consider property taxes or ultitites. A higher percentile indicates that the home is less afordable.

MLS Average

Sale-to-New Ratio

For a complete report of other Canadian cities, and for more information, please refer to the following: http://www.rbc.com/newsroom/pdf/HA-0225-2013.pdf.

Torontonian Online Running in the fast lane! Real estate and more…

Torontonian Online Running in the fast lane! Real estate and more…