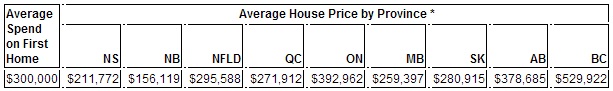

According to a recent report from the Bank of Montreal, the average age of a first-time home buyer in Canada is 29. Of these young home buyers, the majority expect to make a down-payment of approximately $48,000 (roughly one-sixth of a $300,000 home). These statistics vary by region, province, and city – these are only the national figures. For provincial averages, please consult the chart below:

Other Characteristics of First-time Home Buyers in Canada

In light of the aforementioned statistics, BMO reached further conclusions based on their study:

- The average first-time home owner expects to be mortgage free in twenty years. Only 20% believe that it will take 10-19 years to pay off their mortgage.

- First-time home buyers are more likely to favour a fixed rate as opposed to a variable rate mortgage. This includes home owners that believe interest rates may decline in future years.

- Two-thirds of first-time home buyers have been unaffected by Canada’s latest mortgage changes. One-in-five admit to having changed their timeline as a result of reduced amortization periods for long-term mortgages.

In addition, the BMO study reveals average Canadian spending and savings habits, market approaches, and financial expectations. Included in the report, Laura Parson (BMO Mortgage Expert) suggests the viability of shorter amortization for first-time home owners. To further understand the mentality of Canadian first-time home buyers, it is best to weigh the options that they face in terms of mortgages and financing.

Length of Amortization

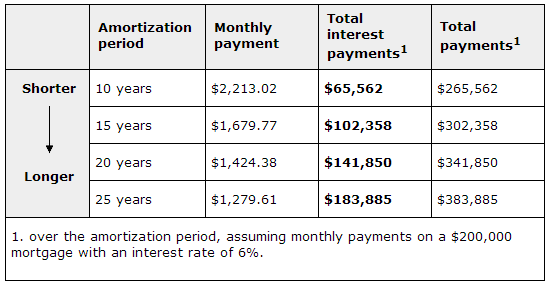

Essentially, the longer the period of amortization is, the lower the monthly payments will be. This is not necessarily a good thing because more interest will be paid than with a shorter mortgage term. Take for example, the following chart outlined by the Government of Canada:

While first-time home buyers may lean towards smaller payments, it is apparent that this is the more costly approach – although sometimes there is no choice in the matter due to limited finances. If you wish to reduce the amount of interest you pay, try arranging more frequent payments, take advantage of prepayment privileges, and investigate a variety of different firms before settling on a mortgage plan. Always verify that your rates are still competitive before renewing a mortgage.

Fixed vs. Variable Rate

Many first-time home buyers opt for a fixed rate mortgage because of the security and certainty that comes along with it. The question as to whether or not rates will rise intimidates many from signing a variable-rate contract. Interestingly enough, the Globe and Mail published an article late in 2012 contrary to this notion, suggesting that variable-rate mortgages are financially viable as they typically entail decreased interest ratings. Since interest rates have been in a downward slope over the past few years, new home buyers are hesitant to take such advice, afraid that the rates will start to inflate again. Historically speaking, over the last 25 years, variable-rate mortgages have been cheaper in 90% of cases – will this trend continue into the future? Many economists believe it will.

Savings

Although six-in-ten prospect first-time home buyers admit to having scaled-back their lifestyle in order to afford the current market values, 27% of the Canadians surveyed still relied on a parent or family member to help with affording their first house. There are many financial tools available for Canadians in need of financial assistance when paying for their first home. It is best that individuals turn to these options, learning how to handle their own cash-flow more efficiently. The following savings techniques are essential for individuals looking to buy their first home:

- Prioritize your savings – consider what is essential and what is frivolous. Do you have more than one car? Do you eat out more than you should? Do you consider cheaper alternatives for doing things? This is all about cutting corners where and when you can to save a few extra bucks a month. Throw these funds into a tax-free savings account and watch your money grow.

- Reduce credit card debt – try to eliminate all lingering debts before saving for that next big investment. A mortgage is a huge commitment and you need to be financially stable, meaning no prior tie-ups before signing a contract.

- Borrow from your RRSP – withdrawal up to $25,000 for a down-payment on your first home. In order to qualify for a withdrawal, however, you must repay the money back within 15 years.

- First-time Home Buyers Program – some cities offer great rates on loans and financial counselling that can help maximize annual savings.

Torontonian Online Running in the fast lane! Real estate and more…

Torontonian Online Running in the fast lane! Real estate and more…