Early last month, in the post Hands Off the Interest Rate, Flaherty!, it was mentioned that Finance Minster, Jim Flaherty, has been interfering with the banks in attempt to prevent a rate-fight. While Flaherty’s motives are understandable, the country’s low interest-rates mark an excellent opportunity for investors to cash-in and for individuals to seek revised mortgage loans. In light of recent events, it now seems as if Bank of Nova Scotia’s CEO, Richard Waugh, is making the same argument: Flaherty needs to stop meddling in the mortgage market.

After the Finance Minister raised concern over reduced mortgage rates currently offered by the BMO and Manulife Financial, Waugh spoke his mind, stating that the government should stop trying to set product pricing. While Flaherty is merely trying to avoid a mortgage market crash and gear the economy towards a “soft landing“, Waugh and many others believe that this is a time for banks to take risks.

Unsecured Lending

As the economy heals it might be best for financial institutions to embrace the possibility of expanding unsecured lending programs. To clarify: unsecured lending requires no collateral, meaning interest-rates are often more severe to lessen the wager for the banks. But with rates in the mortgage market currently in a slump, this is an optimal time for banks to take such a risk. Fixed-rates may prove more advantageous for individuals during the mortgage market low, unlike a variable-rate which is subject to increase if the government continues to intervene. Perhaps, an expansion of fixed-rate unsecured lending would minimize the risk of individuals forfeiting their payments down the line.

Foreign Trade

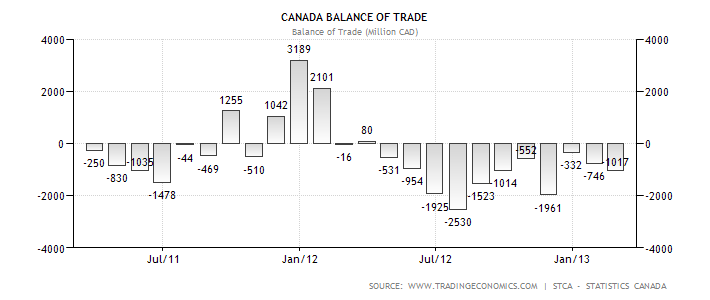

On a separate note, Waugh believes that companies should increase trade with emerging-market countries before America and Europe develop further. Many economists will agree with Waugh: now is the time to seize the opportunity for foreign trade before it passes. In saying this, taking a look back at Statistics Canada’s February report, the trade deficit actually decreased 0.6% — equating to a $1-billion drop since the beginning of the year. Export levels dropped to $38.5-billion in February, while imports rose to $39.5-billion. If foreign trade is to increase, companies need to further embrace exporting, as that is the portion of Canada’s global trading contributing most to the large deficits seen so far in 2013.

Torontonian Online Running in the fast lane! Real estate and more…

Torontonian Online Running in the fast lane! Real estate and more…

One comment

Pingback: The Mortgage Rate Meddler | MortgageResource.ca - Official Site - Canada's one-stop-shop for mortgages