Many home-buyers feel as if the proposal to increase Toronto’s condo development fee is absurd; some developers even believe doubling charges would be “insane”. Regardless of opinion, condo-buyers can expect permit values to rise to $23,000 for a two-bedroom — $12,400 above current rates — if Toronto’s executive committee adopts the proposal. Since Toronto’s condo development fees are the lowest …

Read More »Rob Ford Asks Realtors to Support Land Transfer Tax Reductions

According to Mayor Rob Ford, our city councillors are addicted to the money Toronto’s land transfer tax generates. During the course of a 17-minute speech, Ford requested the help of Toronto realtors in reducing the city’s land transfer tax by 10%. This first step towards eliminating land transfer tax all together is an important political move for Ford, as this is an …

Read More »Property Prices Rise in April 2013

Statistics Canada has released their monthly market update, reporting that the New Housing Price Index (NHPI) rose 0.2% in the month of April, continuing a streak of similar increases over the past year. Of all the Canadian cities, St. John’s experienced the largest property price growth at 1.0%, which is a significant increase compared to many stagnant months after an advance …

Read More »Toronto Real Estate Board’s Market Watch – May 2013

Greater Toronto Area (GTA) REALTORS® reported 10,182 sales through the TorontoMLS system in May 2013, representing a dip of 3.4 per cent compared to May 2012. Sales of single-detached homes in the GTA were up by almost one per cent compared to the same period last year, including a three per cent year-over-year increase in the City of Toronto. “The …

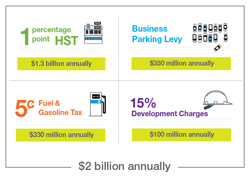

Read More »The Metrolinx Investment Strategy Unveiled

For anyone who commutes daily, it is evident that the Greater Toronto and Hamilton Area (GTHA) faces incredible traffic congestion. What many do not realize, however, is that this gridlock situation is not only inconvenient, but is costing the economy $6-billion each year, according to Ontario.ca. For this reason, Glen Murrary, the Minister of Transportation and Infrastructure, announced yesterday that …

Read More »Building Permits Up 8.6% in March

Earlier this month, Statistics Canada revealed that there was $6.5-billion in building permits issued in March, equating to a 8.6% growth from the previous month. This marks the third consecutive month building permit values have risen, and once again the non-residential sector is responsible for the bulk of the gain. Total value of permits (Stats Can.) Non-Residential Building Permits On …

Read More »The Condominium Act Review: Stage Two

Considering condos amassed to nearly one half of the homes built in 2012, and that over 1.3-million Ontarians claim to be condo-owners, it is not a surprise that efforts to modernize the Condominium Act of 1998 are underway. Currently, we are in the middle of Stage Two of a three-tier collaborative, public engagement process, designed to amend parameters of the old …

Read More »Non-Residential Investments First Quarter 2013

In the first quarter, the total amount of non-residential real estate investments rose to $12.4-billion, continuing the upward trend as the fifth consecutive quarter. In saying this, only four provinces saw significant increases during this time: Quebec, Alberta, British Columbia, and Manitoba. Unfortunately, Ontario was not a part of this list, as institutional investments were down considerably. Of the 34 Census Metropolitan …

Read More »Finance Minister Still Interfering with the Mortgage Market

Early last month, in the post Hands Off the Interest Rate, Flaherty!, it was mentioned that Finance Minster, Jim Flaherty, has been interfering with the banks in attempt to prevent a rate-fight. While Flaherty’s motives are understandable, the country’s low interest-rates mark an excellent opportunity for investors to cash-in and for individuals to seek revised mortgage loans. In light of …

Read More »Canadian Housing Market in for a Soft Landing

Last Tuesday, Statistics Canada released the rates and values of approved building permits nation-wide for February, 2013. Around this time, analysts also discussed the state of the Canadian housing market in March, suggesting that the country is currently in a state of cooling. Following the recession a few years back, Canada was a global leader in real estate growth. It …

Read More » Torontonian Online Running in the fast lane! Real estate and more…

Torontonian Online Running in the fast lane! Real estate and more…