Investment in New Housing

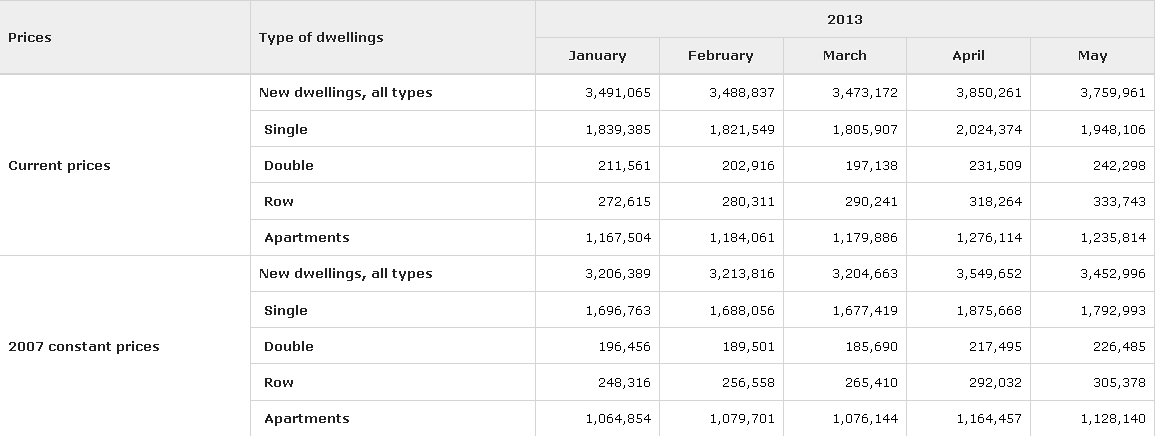

Breaking an upward trend, investments made in new housing developments fell short $90,300 in May, as opposed to the preceding 4-months on the rise. Dwellings considered in this report include: singles, doubles, rows, and apartments. Investments in single units suffered the largest loss in May, down $76,268. Luckily, a substantial jump was seen in rowhouse (+$15,479) and double unit ($+10,789) developments, offsetting a drop in apartment investments (-$40,300).

New Housing Price Index

Following a series of small increases, the Canadian New Housing Price Index increased 0.1% in May. Although Calgary experienced the largest growth (0.9%), many regions in Ontario have been considered top contributors. St.Catherine’s-Niagara, as well as Sudbury and Thunderbay, all rose by 0.6%, which is the highest month-to-month advance in Sudbury and Thunderbay since May 2012.

In the twelve months leading up to May, the Canadian housing market’s NHPI rose 1.8%, which is the smallest gain reported since March 2010. On a year-to-year basis, Toronto and Oshawa pushed the prices forward at 2.6%. Again for Ontario, another significant municipality showing growth was St. Catharines–Niagara at 3.3%. British Columbia, however, reported many new housing price drops, continuing a 16-consecutive downward trend for two of the province’s major regions.

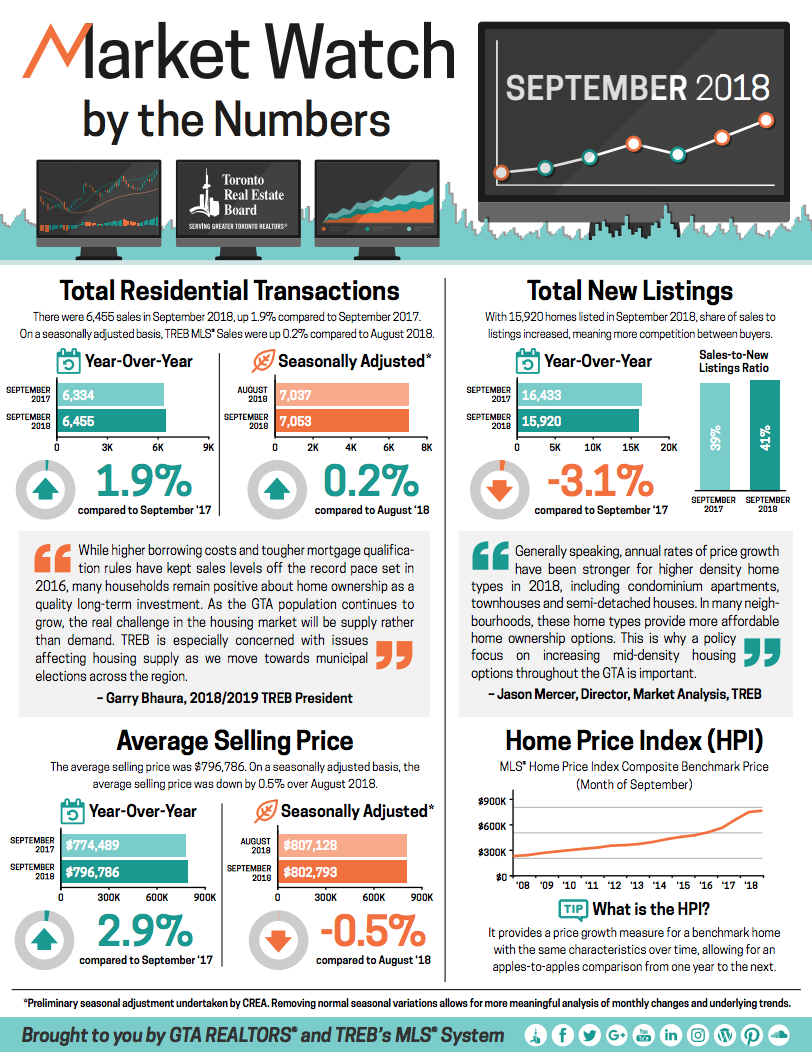

Please click the following for details specific to the MLS in May 2013 and June 2013 (Reports generated by the Toronto Real Estate Board).

Canadian Housing Starts

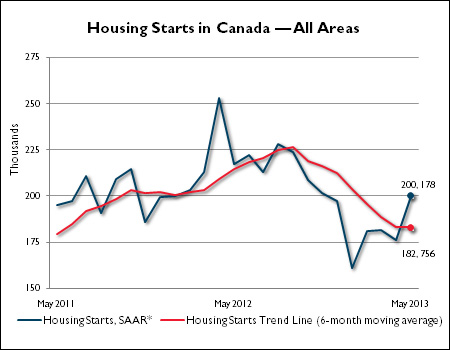

In terms of new beginnings, the Canadian housing market’s Seasonally Adjusted Annual Rates (SAAR) for housing starts jumped significantly between April and May of this year, bringing the month to a total of 200,178 units. For urban settings, the data set forth by the CMHC suggests that the global economy may be in an upswing for the second quarter onward, as cities increased by 14.6% in May. In support of this theory, the strong growth in many Canadian metropolises seems to have had a positive affect on the value of our dollar, which compared to the United States, rose to $1.0181.

Torontonian Online Running in the fast lane! Real estate and more…

Torontonian Online Running in the fast lane! Real estate and more…