This is blowing my mind away!

I came across a news clipping from The Globe and Mail about a property in Willowdale that sold for $1,180,000. At first glance, no big deal, we see properties selling for over a million all the time here so why is it news worthy? It sold $421,800 over the asking price! YIKES! That’s 56% over what the property was listed for!

I want to point out that I’m not insinuating that the REALTOR involved didn’t do their work or acted unethically in anyway but I’m dumb struck at what’s happening!

I reviewed the sales in the neighborhood and there were others that were close to this price but what worries me are couple of things.

When the buyer originally sat with the REALTOR and his/her mortgage broker, what price did they discuss they would be paying?

I know when I meet with my buyers about making their future purchase, one of the first items we discuss is what price range they are looking to make the purchase in. We go through their financials and get a mortgage broker involved in the process. We review the properties in the neighborhood and come up with a value for the property they would be interested in. If the neighborhood is very active and has low days on market, we discuss the possibility of running into a multiple offer situation. We don’t discuss going 50% over asking! It’s something that SHOULDN’T be happening! How do you justify it?

What’s the future value going to be of the property?

I’d like to do a good enough job for my buyer clients now so when they are ready to make the sale in the future, they would first call me to get a repeat of great service. If I don’t discuss the future value of a property with my client, how am I, per say, providing high quality service that would beg them to come back to me. This is where my next dilemma is! What is this property going to sell for in the future? The whole house needs to be renovated which could take anywhere between $250,000 to $500,000 or they might be better off demolishing the house and building a new house on the lot. Was this discussed? What are their projections for the future? Will they be able to recoup their investments? We these discussed as they were sitting in the car outside the house while presenting offers?

I personally think they would have to demolish the house and build a new more energy efficient, state of the art dwelling. This means they get to loose use of the property they just purchased for another six to nine months. I wonder if these options were discussed.

Can they secure financing on the purchase they just made?

So they have bought a place, they have provided with a deposit check of $25,000 or $50,0000 or $100,000 and the mortgage broker tell them that there is an issue. Following are some of the issues that I foresee

- The appraiser hired to complete an evaluation of the property doesn’t think the property is worth the money

- The purchasers don’t have the income to support the purchase price

- The purchasers don’t have enough down payment to cover their purchase

- The lender that provided the mortgage approval can’t fund the transaction

- The lender is reducing their LTV (Loan to value) mortgage and purchasers need to come up with additional funds to close

How much money do they have left over to fix any problems?

The house needs to be completely renovated! When you’re buying a house that is renovated, the cost to renovate is worked into the price and you have to pay a portion of the renovation to acquire the property. Let’s do some number.

Let’s say a property that isn’t renovated is selling for $100,000 versus a property that is renovated with an investment of $20,000 for $125,000. If you were to purchase property A and renovate, you will need to come up with 20% down payment ($20,000) plus $20,000 for the renovation. If you were to purchase property B, you would only have to come up with $25,000. This is also the reason why we advise sellers to complete any outstanding work so the property becomes more attractive to buyers.

In the case above, they have to come up with the down payment plus additional monies to do the renovation. I don’t suppose they will be living in a $1.2M house and bragging about it anytime soon!

As you can see from the list above, there are quiet a lot of items to consider when making an offer on a property.

I’m also questioning my logic as I have found myself in these situations and I can’t justify the price to myself. If I have a hard time justifying the price to myself, I can’t, with a clear conscious and straight face, recommend the price to my clients to pay.

Is it wrong that I ask my clients to setup a max price before we go into a bidding war?

This is a price that I’ve paid numerous times especially since the start of 2012! I have one client that is looking for a property and we seem to always pick the winners. We review our numbers before hand and come up with a max offer and present them to the seller. We lost three properties so far but I’m happy to say that I can sleep well at night with a clear mind knowing that I’m doing the right thing for my clients! My client, on the other hand, is getting tired now and wants to finalize his purchase. Should I push him to make his next offer without any regards for all we discussed?

What do you think? I would love to know how you deal with multiple offers and pressure.

Torontonian Online Running in the fast lane! Real estate and more…

Torontonian Online Running in the fast lane! Real estate and more…

Addy, you seriously think someone who bids $400K over asking is seeking financing? Really? Or what it would cost to reno? Really?

Let’s be real. Those of us who have half a brain no what’s going on here: big Chinese money in full effect, just like what they’ve done in Vancouver, buying crack shacks at $1M plus. If you really want to write an informed blog post, how about you discuss the fact that all this foreign investment is a double edged sword. Yes it makes RE and all those involved a boatload of money, but at the same time these are the same people who are making affordability an issue.

When shoe box condos can sell at $700 PSF

When foreign money is snapping up condos at $700PSF plus (see INDX, 1Thousand Bay) and homes can be had for tens (or I’m this case hundreds of) thousands more, the real issue is what foreign investment is doing to our affordability.

Read the article again, daughter of rich Chinese parents bids excessively on house. You think it will be their only holding? You think this is the last we’ve seen of this? Some 40-60% of millionaire Chinese are willing to leave/divest China and bring that money here. But what does your industry care? Between foreign nationals and first gen immigrants with money here, they have single handedly fueled the pre con condo industry and now they realize the power of holding actual property, no a shoebox in the sky.

Ok… Interesting take on the situation. The intention of the post wasn’t about the effects of foreign investment and I wanted to outline what are the issues of making such crazy offers for Canadians. I don’t work much with international buyers right now.

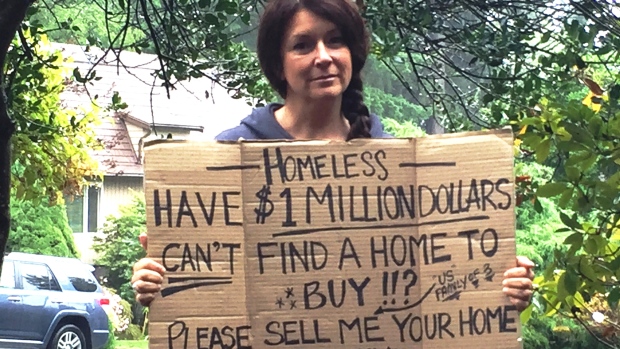

In regards to your comment about affordability, I agree whole heartily with you. We need to ensure we limit foreign investment as it’s driving the average prices too high for first time buyers to enter the market. We need a healthy first time buyers market to fuel our economy. Here’s an interesting story that I tweeted about yesterday that paints a grim picture for our first time buyers. https://twitter.com/#!/HeyAddy/status/177923641328152577

Our current rental vacancy rates are at 1.9% for GTA and are projected to be at 2.1% for 2012 which shows that more and more people aren’t able to afford a purchase and are instead renting. the rental vacancy rate for condos is less than 1% which states the same case.

Foreign investment is also a temporary phenomenon and how much it will impact us when it dries out is something to be seen. At the moment we are seeing a huge demand being placed on first time buyers when they are looking to make their purchase which will hit the breaking point if the interest rates go up or if the mortgage rules get tightened anymore.

Thanks for posting your comments. I will do some more research on your topic and will write a blog about it and will invite you personally for your comments.

Don’t be too seduced by the vacancy figures unless you look at the trends over time (5-6 years) from the same survey. The 1.9% figure you quote is from the CMHC, which makes a number of startling assumptions in its vacancy calculations.