First Quarter TorontoMLS Results (2013)

As of March 2013, the TorontoMLS reported that there had been a total of 7,765 property transactions in the month of March, a figure 17% below March of 2012. Taking a look back over the last few months, Toronto has seen a 14% decrease in transactions during the first quarter compared to last year. What surprised many market experts is the fact that there has been a decrease in first-time home buyer traffic. It is possible that market shortages in some parts of the city are causing these numbers to drop, but it seems more likely that people have learned to be patient and are willing to wait for the property (and price) that best suits their needs. Perhaps, this may account for why there have been frequent bidding-wars over Toronto properties in 2013.

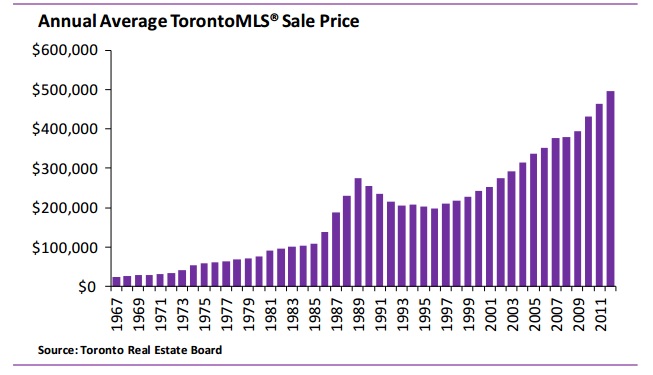

Property Values in Canada

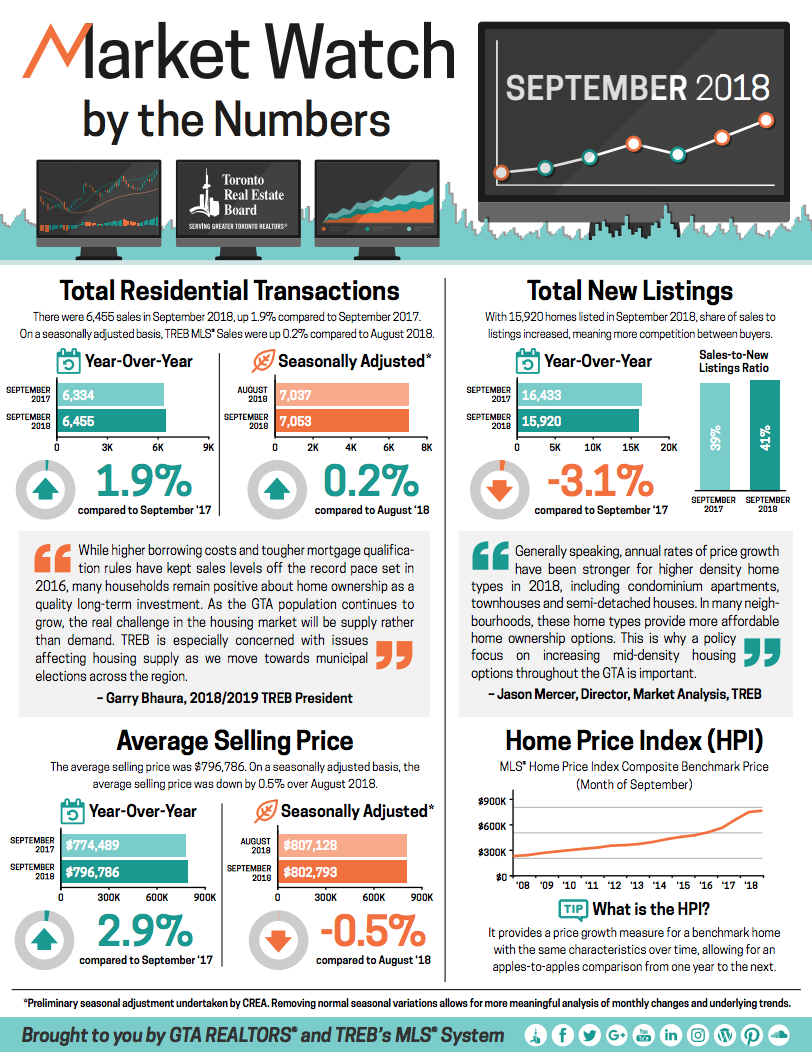

The average selling point in Toronto during March 2013 was $519,879. The total average selling point in Toronto for quarter one had been slightly below this number at $508,066. In comparison to last year’s statistics, both figures are over 3% higher. Since property values remain affordable in regards to average income levels in Toronto, experts believe that property value increases are not influencing the amount of transactions on the market. In saying this, Statistics Canada has released a report that reveals debt-to-income levels in Canada reached a new high at the end of 2012, with mortgage debt growing by $11-billion. Household debt, however, is gradually increasing.

2013 is still on target for a 3.5% property value growth, although the figures have had to adjust slightly. Specific to Toronto, the 2013 Royal LePage House Price Survey reports that the city is experiencing modest growth that will continue into future years. Property values in 2013 are quite high and unlikely to plummet, but the rate of increase will slow down moving into 2014. As it stands, two-story detached homes and bungalows have elevated in price by roughly 4% since last year, while condominiums are up by 1.8%.

Future Forecasts

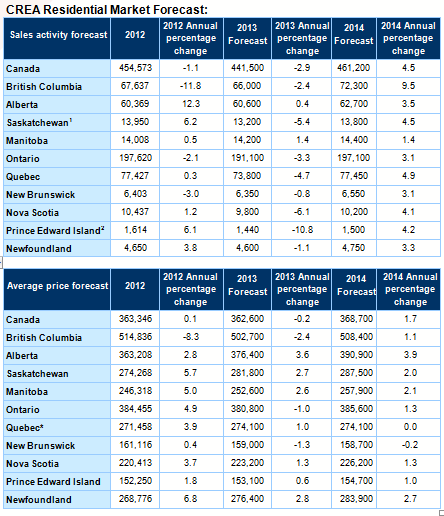

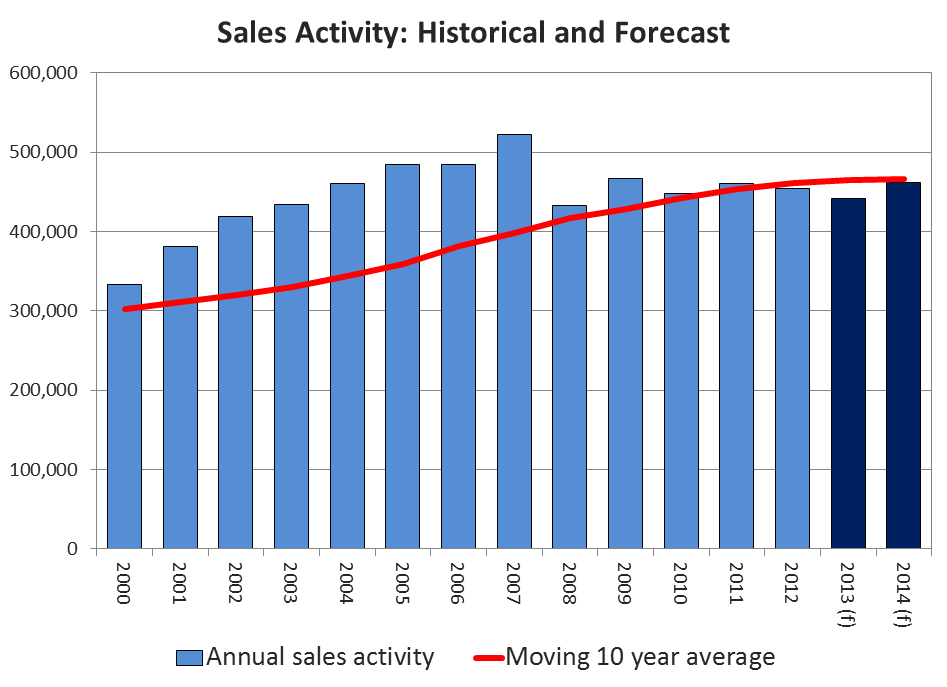

In terms of the 2013 Canadian market, experts feel optimistic that the spring season will correct the trends found of the first quarter. Transactions across the country have been under expectation over the last few months, causing the Canadian Real Estate Association to change their yearly forecast. It can now be expected that there will be 441.500 sales this year, as opposed to the original figure that was 6,000 units larger. Unfortunately, this prediction will still place the Canadian real estate market 2.9% below last year’s final transaction count. Furthermore, national property values are expected to finish the year at $362,600, which is 0.2% down from last year as well.

Torontonian Online Running in the fast lane! Real estate and more…

Torontonian Online Running in the fast lane! Real estate and more…