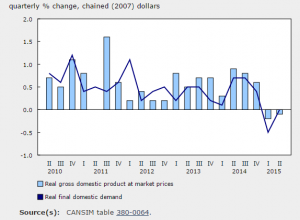

The latest report from Stats Canada on gross domestic product, income and expenditure for the second quarter in 2015 has some interesting numbers relating to the Canadian housing markets and the economy as a whole. With talk of a recession, read below for what you need to know about your real estate investments.

Highlights with regards to housing include:

Investment in housing slows

Following a 0.9% increase in the first quarter, business investment in residential structures grew 0.3% in the second quarter. A decrease in new housing construction (-4.1%) was mitigated by an increase in renovations (+0.3%) and ownership transfer costs (+10.4%), indicating continued strength in housing resale activity.

Household spending increases

Household final consumption expenditure increased 0.6% in the second quarter, following a 0.1% gain in the first quarter. Consumers increased spending on goods by 0.3%, led by durable goods (+1.6%), while services grew 0.8%.

Transport purchases (+1.5%) contributed the most to the growth in household final consumption, boosted by a 2.9% increase in purchases of vehicles. Outlays on insurance and financial services (+1.2%) and food, beverage and accommodation services (+1.2%) also contributed to the growth in household spending. Electricity, gas and other fuels declined 4.6%, the largest decrease since the fourth quarter of 2011.

Household saving rate declines

The household saving rate decreased from 5.2% in the first quarter to 4.0% in the second quarter, as household final consumption expenditure (nominal terms) increased while household disposable income declined. The household debt service ratio, defined as household mortgage and non-mortgage payments divided by disposable income, was 14.07%, up from 13.90% in the first quarter. The second quarter national saving rate was 2.9%, down from 3.6% in the first quarter, slowing for a third consecutive quarter. Higher corporate savings were mainly offset by lower savings of households.

The weaker dollar isn’t all bad news. Our exports have been boosted as a result which means that we will see continued economic growth in Ontario.

New housing statistics are down reflecting an increase in sale prices for new housing (up by 0.3%). Homeowners are spending money on renovating rather than selling leading to a continued shortage of inventory of properties available for sale. That being said, resale properties are selling faster resulting in an increase of over 10% in transfer of ownership.

What are your concerns with the decline in GDP as it relates to your real estate investments? I’d love to help you make smart choices when buying, selling and leasing in this current economic climate.

Torontonian Online Running in the fast lane! Real estate and more…

Torontonian Online Running in the fast lane! Real estate and more…